We use cookies to understand how you use our site and to improve your experience.

This includes personalizing content and advertising.

By pressing "Accept All" or closing out of this banner, you consent to the use of all cookies and similar technologies and the sharing of information they collect with third parties.

You can reject marketing cookies by pressing "Deny Optional," but we still use essential, performance, and functional cookies.

In addition, whether you "Accept All," Deny Optional," click the X or otherwise continue to use the site, you accept our Privacy Policy and Terms of Service, revised from time to time.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

First National (FXNC) Declares Buyout of Touchstone Bankshares

Read MoreHide Full Article

First National Corporation (FXNC - Free Report) and Touchstone Bankshares, Inc. have announced a merger agreement. Per the deal, FXNC will acquire Touchstone Bankshares in an all-stock transaction. The closing of the deal is expected in the fourth quarter of 2024, subject to shareholder and regulatory approvals and customary conditions.

Shares of First National lost 7.53% following the announcement of the transaction. This was likely due to FXNC paying a hefty premium of 45.7% on the deal.

Touchstone Bankshares is a leading financial services provider in south-central Virginia and northern North Carolina. As of Dec 31, 2023, Touchstone Bankshares’ total assets were $658.7 million, gross loans were $508.8 million and total deposits were $542.2 million.

Deal Terms and Financial Overview

According to the agreement, Touchstone Bankshares’ shareholders will receive 0.8122 shares of First National stock for each Touchstone Bankshares share. Based on the closing price of $17.55 on Mar 22, 2024, the deal is valued at $47 million, or $14.25 per Touchstone Bankshares share.

The transaction between First National and Touchstone Bankshares will bring two community-focused banks, strengthening their commitment to their customers and communities. According to the deal, the combined assets of both banks are expected to be $2.1 billion, with $1.5 billion in loans, $1.8 billion in deposits and 30 branches in Virginia and two in North Carolina.

The company's combined deposits are anticipated to surpass $350 million, with eight branches serving in the Richmond area.

The expected cost savings of the combined company are approximately $7.2 million, equivalent to 35% of Touchstone Bankshares’ non-interest expense.

The deal will enhance the scale of operations, which will allow the bank to disburse higher loan amounts and increase organizational efficiency.

The transaction will further allow it to strengthen its deposit base. Both banks hold strong positions with low cost and long duration deposits, resulting from century-long engagement in the respective markets.

The successful completion of the merger will make the company Virginia’s ninth-largest community bank by deposit volume. Also, FXCN anticipates a 36% increase in earnings per share and estimates a tangible book value dilution earn-back period of around three years.

Management Comment

As stated by Scott Harvard, president and chief executive officer of First National Corporation, “We are thrilled to have found a partner with an equally long history of serving and supporting local customers and businesses in their communities. Combining our companies will help ensure that we continue to be part of the fabric of the communities we serve, which we believe enables us to deliver superior service and financial performance. We are incredibly excited about this opportunity to expand our Richmond metro presence with the addition of seven branches in the market, and we look forward to welcoming the entire Touchstone team into the First Bank family.”

President and chief executive officer of Touchstone Bankshares, James Black, stated, “First National is a like-minded partner that shares our culture of supporting our communities by focusing on building meaningful relationships and personalized service to their customers. We are enthusiastic about the opportunity to partner with First National in a transaction that we believe offers significant opportunities to our clients, communities, employees, and shareholders. This partnership is an excellent opportunity to create value for both institutions.”

Our View

The merger between First National and Touchstone Bankshares marks a significant step toward strengthening community-focused banking. With shared visions and a commitment to achieving service excellence, this strategic merger assures enhanced value for stakeholders and strengthened community ties.

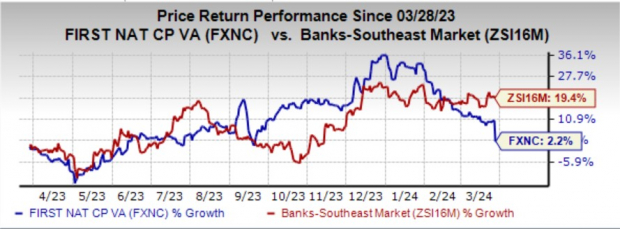

In the past year, shares of FXNC have gained 2.2% compared with 19.8% growth recorded by the industry. Image Source: Zacks Investment Research

Last month, Capital One (COF - Free Report) inked an agreement to acquire Discover Financial Services in an all-stock transaction valued at $35.3 billion. This strategic move is poised to reshape the landscape of the credit card industry, create a behemoth in the industry and unlock substantial value for shareholders while raising questions about regulatory scrutiny and competitive dynamics within the market.

The deal between COF and DFS is expected to close in late 2024 or early 2025, subject to the satisfaction of customary closing conditions, including regulatory nods and approval by the shareholders of both companies.

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

First National (FXNC) Declares Buyout of Touchstone Bankshares

First National Corporation (FXNC - Free Report) and Touchstone Bankshares, Inc. have announced a merger agreement. Per the deal, FXNC will acquire Touchstone Bankshares in an all-stock transaction. The closing of the deal is expected in the fourth quarter of 2024, subject to shareholder and regulatory approvals and customary conditions.

Shares of First National lost 7.53% following the announcement of the transaction. This was likely due to FXNC paying a hefty premium of 45.7% on the deal.

Touchstone Bankshares is a leading financial services provider in south-central Virginia and northern North Carolina. As of Dec 31, 2023, Touchstone Bankshares’ total assets were $658.7 million, gross loans were $508.8 million and total deposits were $542.2 million.

Deal Terms and Financial Overview

According to the agreement, Touchstone Bankshares’ shareholders will receive 0.8122 shares of First National stock for each Touchstone Bankshares share. Based on the closing price of $17.55 on Mar 22, 2024, the deal is valued at $47 million, or $14.25 per Touchstone Bankshares share.

The transaction between First National and Touchstone Bankshares will bring two community-focused banks, strengthening their commitment to their customers and communities. According to the deal, the combined assets of both banks are expected to be $2.1 billion, with $1.5 billion in loans, $1.8 billion in deposits and 30 branches in Virginia and two in North Carolina.

The company's combined deposits are anticipated to surpass $350 million, with eight branches serving in the Richmond area.

The expected cost savings of the combined company are approximately $7.2 million, equivalent to 35% of Touchstone Bankshares’ non-interest expense.

The deal will enhance the scale of operations, which will allow the bank to disburse higher loan amounts and increase organizational efficiency.

The transaction will further allow it to strengthen its deposit base. Both banks hold strong positions with low cost and long duration deposits, resulting from century-long engagement in the respective markets.

The successful completion of the merger will make the company Virginia’s ninth-largest community bank by deposit volume. Also, FXCN anticipates a 36% increase in earnings per share and estimates a tangible book value dilution earn-back period of around three years.

Management Comment

As stated by Scott Harvard, president and chief executive officer of First National Corporation, “We are thrilled to have found a partner with an equally long history of serving and supporting local customers and businesses in their communities. Combining our companies will help ensure that we continue to be part of the fabric of the communities we serve, which we believe enables us to deliver superior service and financial performance. We are incredibly excited about this opportunity to expand our Richmond metro presence with the addition of seven branches in the market, and we look forward to welcoming the entire Touchstone team into the First Bank family.”

President and chief executive officer of Touchstone Bankshares, James Black, stated, “First National is a like-minded partner that shares our culture of supporting our communities by focusing on building meaningful relationships and personalized service to their customers. We are enthusiastic about the opportunity to partner with First National in a transaction that we believe offers significant opportunities to our clients, communities, employees, and shareholders. This partnership is an excellent opportunity to create value for both institutions.”

Our View

The merger between First National and Touchstone Bankshares marks a significant step toward strengthening community-focused banking. With shared visions and a commitment to achieving service excellence, this strategic merger assures enhanced value for stakeholders and strengthened community ties.

In the past year, shares of FXNC have gained 2.2% compared with 19.8% growth recorded by the industry.

Image Source: Zacks Investment Research

Currently, FXNC carries a Zacks Rank #2 (Buy).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Inorganic Expansion Efforts by Other Banks

Last month, Capital One (COF - Free Report) inked an agreement to acquire Discover Financial Services in an all-stock transaction valued at $35.3 billion. This strategic move is poised to reshape the landscape of the credit card industry, create a behemoth in the industry and unlock substantial value for shareholders while raising questions about regulatory scrutiny and competitive dynamics within the market.

The deal between COF and DFS is expected to close in late 2024 or early 2025, subject to the satisfaction of customary closing conditions, including regulatory nods and approval by the shareholders of both companies.